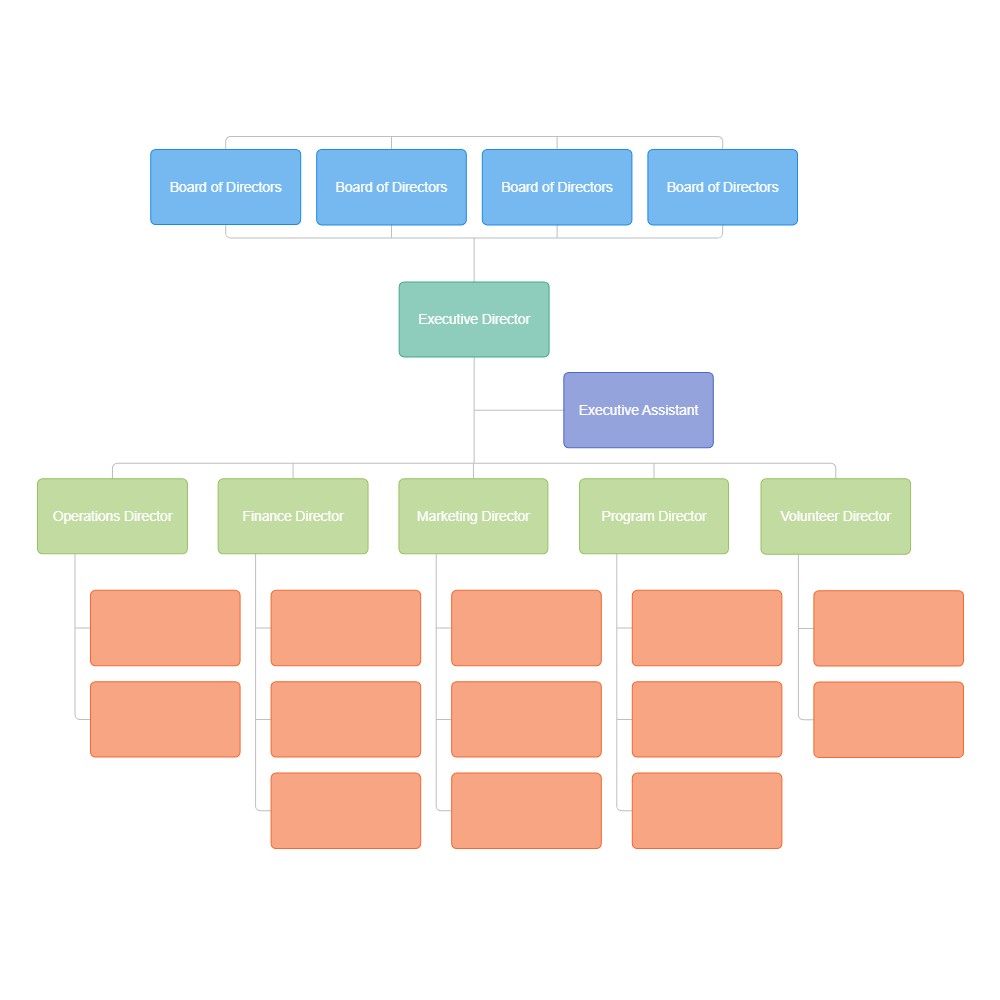

Profits in a Not-for-Profit hospital implies that whoever the profits are distributed to eventually would affect the product mix, the costs, the input mix, and even the size of the hospital. Organizational Structure of Non-Medical Staff/Line Management The organization of the Not-for-Profit hospital is dominated by the Board of Trustees. Jan 8, 2020 - Non Profit organizational Chart Template - Unique Non Profit organizational Chart Template, Non Profit Board organizational Chart organization Chart. The Nonprofit Organizational Charts is available to edit and customize. Explore whatever fits you best and save for your own use. Quickly get a head-start when creating Nonprofit Organizational Charts. Organizational chart templates templates for word ppt and nonprofit annual reports 7 best practices templates flow chart template word line t luxury graph templates six levels nonprofit org development workflow chart 5 best of non profit blank organizational charts media plan flow chart template excel market research traditional nonprofit organizational structure 107 organizational chart.

Red Cross Non-profit Organizational Chart Example

If you want to build a small charity organization for those in need, the Red Cross non-profit organizational chart might give you inspirations. The employees in the Red Cross org chart are distributed in five divisions - law and policy, communication and information management, operations, financial resources and logistics and human resources.

Click here to free download the Org Chart Software. Feel free to use the rich built-in templates.

Public Health Non-profit Organizational Chart Example

The public health non-profit organizational chart displays how public health is managed in a professional organization. This organizational chart displays a more complicated hierarchical structure in an organization than the example above. Free download the chart to view more details and change the theme and layout with excellent organizational chart maker.

Plant Protection Non-profit Organizational Chart Example

Plant protection matters to the life and death of life on the earth. The plant protection non-profit organizational chart displays the organizational structure of a non-profit plant protection organization. Feel free to customize the theme and layout of the example to fit your style.

More Organizational Chart Examples and Templates

Non Profit Organizational Chart Examples

The following organizational chart examples represent more organizational charts.

| Sales Department Organizational Chart | Civil Service Organizational Chart |

| Content Marketing Organizational Chart | Hospital Organizational Chart | Staff Performance Organizational Chart |

Related Articles

Staff Organization Chart Non-profit

Whether you’re launching a brand-new nonprofit or just trying to get more organized, it can be hard to know where to begin. When it comes to accounting, the first step is to create a chart of accounts. The chart of accounts (or COA) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Every nonprofit organization has a unique COA that depends on your specific programs, revenue sources, and activities. But in general, your COA should follow some standard guidelines and numbering conventions.

A chart of accounts is commonly numbered as follows:

Organizational Chart Non Profit

Statement of Financial Position

Assets: 1000-1999

Liabilities: 2000-2999

Equity/Net Assets: 3000-3999

Statement of Activities

Revenue: 4000-4999

Expenses: 5000+

This means that any assets owned by your nonprofit (like bank accounts, investments, property, and equipment) should be numbered in the 1000 range. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. Your organization’s restricted and unrestricted net assets should be numbered in the 3000 range. Revenue from donations or sales should be in the 4000 range, and expenses for programs, utilities, salaries, and everything else should be numbered as 5000 or above.

When you’re numbering your accounts, follow these three rules:

Organization Chart Non-profit

Keep things simple. You don’t need separate accounts for paper, pens, envelopes, and staples; you can just have one account for office supplies. If you need more detailed layers of organization, you can add class codes.

Group similar accounts together. It’s easier to read and understand your financial reports when your accounts are listed in a logical order.

Leave room for growth. You can’t group similar accounts together if all the numbers are already taken! Think about how your needs might change in the future, and leave gaps between your account numbers so you can add new accounts later.

Non-profit Organizational Chart Template Word

Below is a sample chart of accounts for nonprofit organizations. Remember, this is only an example – your nonprofit might have different types of revenue and expenses, or own different assets that will alter your chart of accounts. Use this as a guideline, and think carefully before you finalize your account numbers. Build a solid framework that you can easily add to in the years to come!

1010: Checking (Bank Account)

1030: Savings (Bank Account)

1110: Investments

1210: Accounts Receivable

1310: Inventory

1410: Prepaid Expenses

1510: Property

1530: Equipment

1590: Accumulated Depreciation

1690: Accumulated Amortization

2010: Accounts Payable

2100: Accrued Salaries

2110: Accrued Payroll Taxes

2115: Accrued Employee Benefits

2150: Accrued Property Taxes

2200: Deferred Revenue

2300: Credit Card Payable

3100: Unrestricted Net Assets

3200: Temporarily Restricted Net Assets

3300: Permanently Restricted Net Assets

4010: Donations and Grants – Individuals

4020: Donations and Grants – Government

4030: Donations and Grants – Foundations

4110: Special Events – Sponsorships

4120: Special Events – Auction

4130: Special Events – Ticket Sales

4200: Program Revenue

4300: Sales of Merchandise

4500: Membership Dues

4600: In-Kind Contributions

4700: Temporarily Restricted Income

4800: Permanently Restricted Income

4900: Interest Income

4910: Dividend Income

5000: Salaries and Wages

5010: Payroll Taxes

5030: Health Insurance

5040: Dental Insurance

5050: Retirement Benefits

5060: Workers Compensation

5070: HSA Contributions

6000: Depreciation Expense

6100: Amortization Expense

7000: Cost of Goods Sold

8000: Fundraising Expenses

8100: Special Event Expenses

8200: Program Expenses

8300: Marketing and Branding

8310: Advertising

8410: Contract Services

8420: Accounting Services

8430: Legal Services

8510: Rent Expense

8520: Utilities

8525: Telecommunications

8530: Maintenance and Repairs

8540: Office Supplies

8550: Printing and Copying

8560: Postage and Shipping

8570: Licenses and Permits

8610: Bank Fees

8620: Merchant Service Fees

8810: Board Expenses

8820: D&O Insurance

8890: Miscellaneous Expenses